Abstract

The late Ronald Harry Coase , formerly the Clifton R. Musser Professor of Economics at the University of Chicago Law School and the recipient of the Nobel Memorial Prize in Economic Sciences, put forward an excellent discussion on the theory of external costs and property rights in transaction. He believed that the definition of property rights for externalities would effectively solve externality problems and reduce transaction costs. The current carbon rights trading is based on this theory.

This article mainly proposes a framework model, through the method of evaluation of externalities, combined with the technology of virtual currency, to develop an external transaction network and mechanism. Since the development of human society, the currency has been used as the medium of transactions to exchange goods and services. People develop goods and services based on their expertise and efficiency, and they meet each other’s needs through transaction mechanisms. Since the Industrial Revolution in the 18th century, advances in technology and efficiency have enabled people’s basic needs to be met through the exchange of goods in large quantities. And the fulfillment of higher-level needs, such as well-being, achievement, beauty, environment, etc., is restricted by the limitations of technology and trading platforms, which cannot efficiently trade intangibles as they do physical goods. The intangible but valuable goods and services cannot be displayed and valued, which has also led to the deterioration of the global environment and the proliferation of social problems.

The current evaluation methods for intangible externalities, through the global ESG wave, have gradually matured the current evaluation methods and frameworks for environmental and social externalities, such as SROI , True Value, TIMM , Total Value, etc. The review and assurance of non-traditional financial information has also become possible after the emergence of AA1000 and ISAE3000 certification and assurance standards. However, because of the complex types of environmental and social externalities, such as greenhouse gases, water resources, waste, educational opportunities, sense of accomplishment, sanitary conditions, etc. Due to the global nature of climate change, the Kyoto Protocol has made greenhouse gases a tradable environmental externality target and directed funds and technology to the field of carbon reduction. However, other types of external environmental and social benefits still lack an effective trading platform today.

The technology of virtual cryptocurrency provides possible solutions. Virtual currency can be recorded, traded, and circulated, and it provides a safe trading environment. This article argues that external transactions should be independent of the original financial currency market. Therefore, a virtual currency, or value coin, should be used as a medium for external transactions.

This article will use subsequent chapters to analyze the theory, structure, and transaction mode associated with virtual currencies.

A matchmaking trading platform that combines virtual currency with environmental and social welfare is stored in a server. The platform contains an index sorting unit that sets prices for environmental and social goals. Users can select the project sorting unit of the execution target, connect to the project sorting unit and provide a matching unit for query, connect to the matching unit and provide the investment unit for capital investment, and connect the project sorting unit and use it to calculate virtual currency. Calculation of the amount of an acquisition is performed by a verification unit connected to an achievement calculation unit and checked by a third party, and a virtual currency management unit connected to the achievement calculation unit and used to issue virtual currency. A trading unit that connects and uses virtual currency to buy and sell.

Keywords: virtual currency, externalities, social value, environmental value

Introduction

Since the Industrial Revolution, the living standard of human society has greatly improved, but this improvement has also produced risks and harms to the environment, ecology, and society. The main reason is that the current accounting system cannot effectively measure externalities, which distorts the current prices of goods and labor transactions as well as the measurement standards of corporate and personal wealth. Consequences of such distortion include environmental destruction, inequality between rich and poor, ecological catastrophes, and other crises. This article proposes an operating model for value coin in the hope of creating an external value transaction system independent of the capitalist system through the use of external evaluation systems, virtual currency technology, trading platforms, electronic books, and accounting principles. Such a model would allow organizations and individuals to efficiently create social externality benefits or reduce externality costs, focus on creating externality values, and secure reliable transactions. This system would be independent of the current transaction and currency system, mainly due to the following reasons:

1. The result and process of creating external value, by measuring the external value of the environment and society, and using value coin as the measurement benchmark for another type of wealth value and success definition.

2. Avoidance of interference from the current financial capital market operation mechanism. For example, in a renewable energy project that produces economic and environmental benefits at the same time, the original accounting system will assess the transaction price of the project on the current capital market. Integrating external benefits into the accounting system for the collaborative evaluation would cause confusion between the two.

Operating Model & Trading Structure

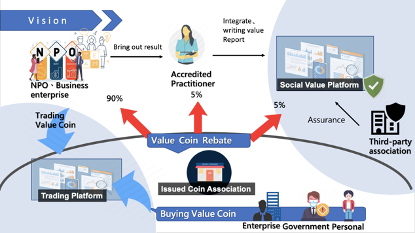

The following explains the roles played by each role in the business model:

1. Value creators(Value Miner): Value creators are entities that perform work to solve social problems or improve social well-being, such as reducing greenhouse gas emissions, collecting marine garbage, reducing poverty, solving hunger, improving human health. Value creators will be able to get 90% of the value coin as a reward for their efforts in the business model.

2. Record node: After the value has been created, it needs to be recorded through a strict method structure, just as a company needs to record revenue and cost information through accounting after it creates revenue. The record node is the organization or individual that records the external value through a fair methodology. Only the record node is eligible to log in the value creator’s project to the value platform and send it to a third-party organization for certification. Each record node saves the value book and value coin book of the entire business model, confirming that the information of the entire business system is correct. There can be multiple record nodes, just as there can be multiple corporate financial staff.

3. Value evaluation platform: A large amount of data is needed to evaluate and confirm the value. The value evaluation platform provides information (historical data, past projects, evaluation methods, etc.) as a tool to record the quality of the records of the nodes and as a platform for inter-industry communication and evaluation of the record nodes. In addition, the value evaluation platform develops a standard format and provides it to a third-party certification body as a certification model and structure. There can be multiple value evaluation platforms, but they should be qualified, just as in the accreditation of a laboratory.

4. Third-party agency: The value platform will send the recorded value report to a third-party machine channel, which will review and evaluate the methodology and information for reasonableness, accuracy, and fairness in accordance with internationally recognized certification and assurance standards. The certified value report will be sent to the currency-issuing institution to issue currency based on the certified value. There can be more than one certification body, just as there can be multiple accountants responsible for auditing financial reports.

5. Currency-issuing agency: An independent currency-issuing agency issues value coin for certified value reports and controls the amount of currency issued based on the total amount of currency issuance. Only one currency-issuing institution is allowed.

6. Trading platform: A trading platform is used to make exchanges involving value coin and sovereign currency. There can be multiple trading platforms.

Externality Evaluation Method

Evaluation Method

There are many existing evaluation and measurement frameworks and methodologies for external benefits and external costs, such as SROI, TIMM, True Value, Total Value, etc. Just like the transaction evaluation mechanism of intangible assets and corporate mergers and acquisitions in the current financial market, the corporate culture, human capital, business secrets, and other things will be given monetary value before the transaction is formed. This value coin will take the value of solving social problems as the value benchmark for issuance. In all evaluation methodologies, the network derived from the SROI method[1] structure published by Social Value International is relatively complete and close to the current corporate accounting structure. Therefore, this article adopts the SROI evaluation method but does not exclude other methods and frameworks. The following will first take the SROI method framework published by Social Value International as an explanation.

In the methodological framework of SROI, there is a calculation model like the BS Model formula of derivative financial instruments, and even the relevant hypothetical parameters can be determined in a scientific and objective way. Verification can prove to be an excellent evaluation mechanism.

In addition to the objectivity of the evaluation mechanism, Social Value International has also established a complete assurance certification mechanism and practice mechanism, so the currency will be built on the Social Value International network as the core. The record node is a qualified accredited practitioner on Social Value International, which is responsible for compiling a value report in accordance with the SROI methodology framework. The SROI principle issued by Social Value International will become the main principle for implementing certification for third-party organizations.

Record the Value Report of the Node

Under the current Social Value International mechanism, the recorder uses the SROI methodology framework to record the activities, costs, and parameters of the value creators and compiles a report. The proof of value in the value coin system should also be written into a value report based on the SROI methodology framework. By recording the activities, costs, price creation process, and various hypothetical parameters of value creators in the report, the value report can become a public supporting document under the value coin operation structure. Value-creating activities are required to submit value reports as documents supporting value, just as current companies submit financial reports. However, if the value creator does not have the expertise required to record value reports, qualified SROI-accredited practitioners can be appointed to assist in writing and recording value reports, and the value reports will be sent to a third-party certification agency for certification through the accredited practitioner.

Third-party Identification and Confidence

In establishing the value of the value coin, the main purpose is to confirm that the value report information recorded and written on the record node can prove the existence of the value activity and the value created. There are no major misstatements in the five assertions on the value report:

1. Value activities and the value created exist and occur.

2. Value activities and the value created has been fully incorporated and comply with the principle of materiality.

3. The rights, obligations. and relationships between value creators, value activities, are defined correctly.

4. Recording, evaluation, and calculation of value activities and the value created is right.

5. Expression and disclosure of value activities and the value created are right.

In the assurance system, it should be divided into two aspects: 1. Methodological framework and process certification 2. Assurance of actual data.

Methodology Structure and Process of Identification

The current Social Value International certification and the AA 1000 TYPE I certification system are close to the control test in modern auditing. The purpose of this certification is mainly to confirm the value activities and the value created, which are recorded, evaluated, assumed, and calculated under the correct methodology. This article recommends that the evaluation methodology be issued by the unit, such as Social Value International, to implement.

The Confidence of the Data in the Value Report

The current international ISAE 3000 and AA 1000 TYPE II certification systems are similar to the verification test in modern auditing. The purpose of these systems is mainly to confirm that the value activity data recorded in the value report are correct and non-falsified. This article recommends appointing a local accountant for value creation activities to directly verify and assure the local information.

Value Coin

The Generation and Conversion of Value Coin

When the value report is certified and confirmed by a third-party organization, the value coin will be generated at the ratio of the value of 100,000 U.S. dollars to 1 value coin.

When the value report is handed over to the recording node, the recording node’s system will generate the exclusive code of the value report through the encryption technology of the blockchain and send it to every recording node, value platform, and third-party certification agency in the network. When the value in the value report is finally confirmed, the third-party certification agency will use the same blockchain encryption technology to generate the final exclusive code to replace the original exclusive code and send it to the recording node, the value platform, and the currency issuing agency. Finally, the currency issuing agency will issue value coin based on the value recorded in the certified and convinced value report, using the ratio of 100,000 U.S. dollars to 1.

Value Coin Issuance Ceiling

The original intention behind the development of the value coin system was to solve social problems through independent financial and capital market systems. Currently, the most critical global issues are articulated in the United Nations’ 17 Sustainable Development Goals (SDGs). The related literature points out that there is still a financial gap of approximately USD 2,500,000,000,000[2] to achieve the SDGs. Therefore, if 100,000 U.S. dollars is used as the value coin of the exchange ratio, the upper limit of the currency is 25,000,000 value coins.

Because the SDGs express the global consensus on externalities, they are suitable as a benchmark for solving problems and externalities. Therefore, the value coin will only be converted to the value of influence in the SDG fields and will not be included in other fields for the time being.

Award

Value Mining

The core of the value coin system is to solve the externality problem on which there is a social consensus, so the main reward objects are also those entities that solve social problems through various activities and mechanisms. Individuals or organizations that solve social problems only need to prove that they can get rewards for solving social problems, and they do not need to get rewards through the current capital market transaction mechanism. Therefore, the miners under the value coin are the people and organizations who actually solve social problems.

The essence of value coin is the embodiment of human consensus values to solve global problems. This fundamental principle should not suffer interference from noise from capital markets, property markets, sovereign states, etc. Only independent operation and transaction structure of the value coin transaction mode can solve critical global problems.

Allocation Mechanism

The value creator is the main contributor and should obtain 90% of the value coin. The record node must assist in recording price-making activities and maintaining the ledger, so 5% of the value coin should be allocated. The value appraisal platform provides data analysis and platform for record nodes as well as certification and assurance institutions, so 5% of the value coin is also obtained in each value confirmation.

Required Resources

The Core Idea of Value Coin

Most humans, regardless of race, religion, gender, skin color, nationality, or wealth, have common values for well-being. However, due to the current capital market and sovereign state mechanisms, well-being cannot become a common global goal. The credit basis for the issuance of value coins lies in the common values of mankind all over the world. It is hoped that through value coin, global humans can focus on solving global problems and resolve the contradictions between the current financial capital system and global social problems.

I ultimately hope that outstanding achievements that can solve social problems will no longer need to be converted to capital or goods and labor markets to survive.

Resource Gap

The realization of the operating structure of the value coin requires a huge amount of funding and professionalism. If Social Value International cannot join the operation of the system, it will require more construction costs. Funds are needed mainly to build a technical team, structure a value coin system, and create the first value evaluation platform. It is hoped that an international technical team and financial sponsors can help support the realization of the value coin system and solve social problems.

Statement

The author of this article reserves the right and copyright for the interpretation of this article. Please do not share, reprint, excerpt or plagiarize without the author’s consent.

Du, 2021.

[1] Resources :https://www.socialvalueint.org/principles

[2] Resources: https://www.ifc.org/wps/wcm/connect/842b73cc-12b0-4fe2-b058-d3ee75f74d06/EMCompass-Note-73-Closing-SDGs-Fund-Gap.pdf?MOD=AJPERES&CVID=mSHKl4S